Investor-ready financial projections

Raising capital – whether angel capital, venture capital, bank loan, convertible note, venture debt, or any other form of financing – is a time consuming and challenging task for many startups, small, and medium-sized businesses. Use our software to do this easily or ask us to help build your model. Companies have raised seed and later stage capital, as well as loans, using financial projections created with our software.

Present with confidence

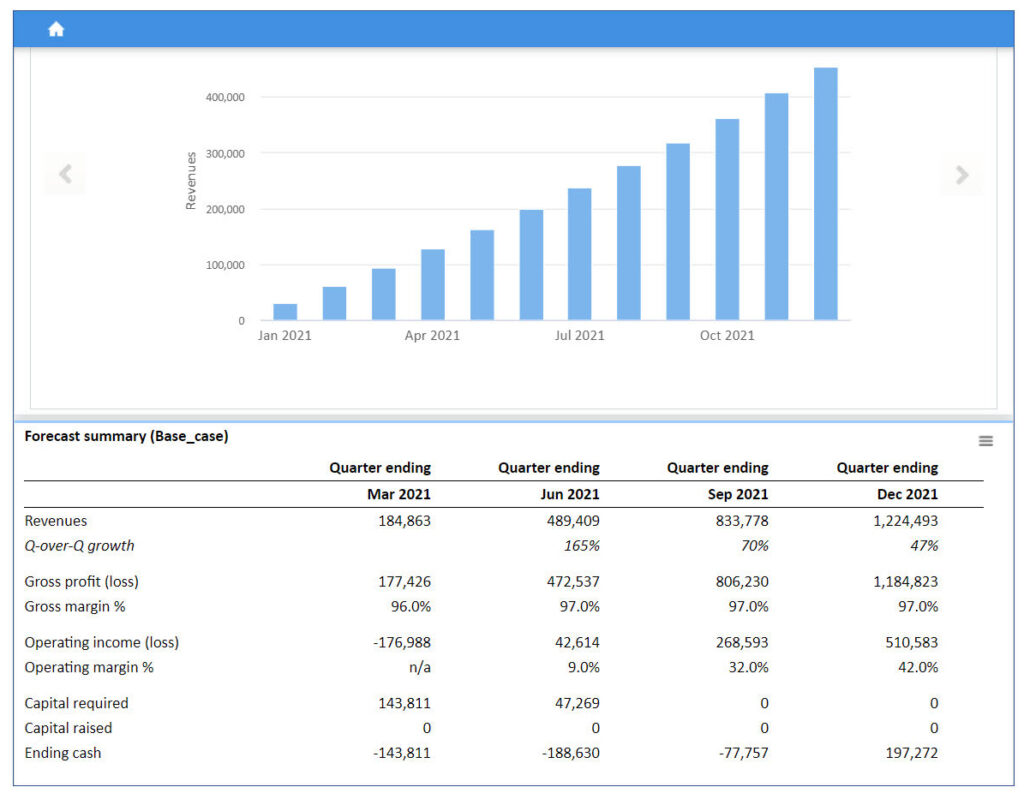

Create a financial plan exactly for your requirements to showcase your business and present with confidence.

Anticipate the questions your investors or lender would have. You have access to comprehensive reports to draw insights into your business and respond effectively.

- Is your revenue growth attractive?

- Are your cost assumptions realistic? Are they sufficient to meet revenue targets?

- What are your unit economics? For a SaaS company this may be a metric like LTV/CAC. For a product business, this might be gross margin in a unit basis.

- Does your business offer strong return on investment potential?

- What type of financing would work best for your business?

- If seeking a loan, do you have cash flow to cover interest and principal obligations?

TIP: Your forecast can be for any number of months and presented in detail or at a glance

Estimate and manage capital requirements

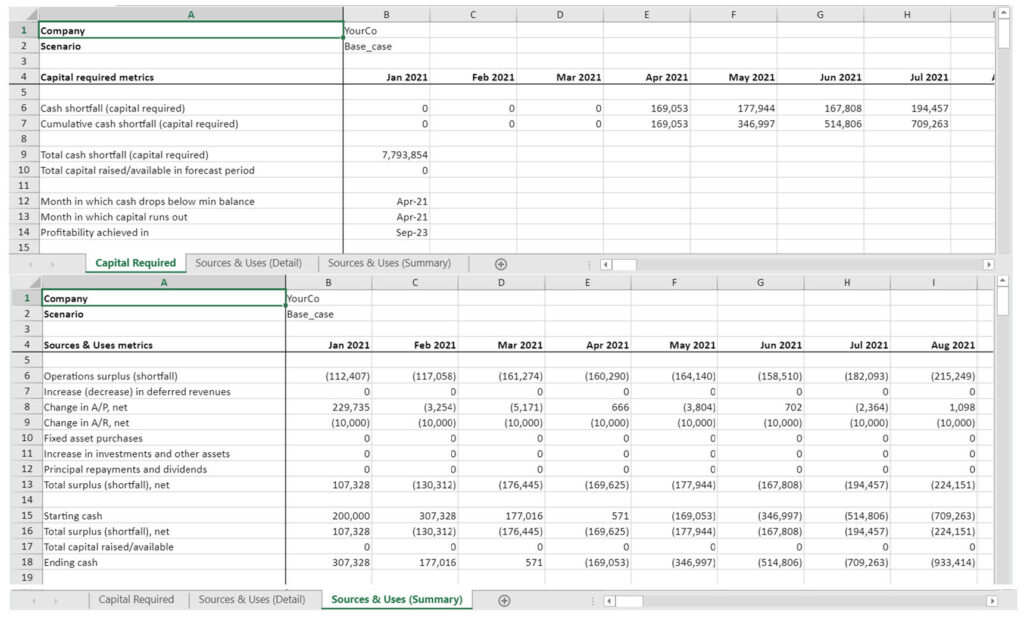

Estimate how much capital you’ll need, the runway you have before you need more cash, and when you expect to become profitable.

- Our comprehensive capital requirements report, which is generated automatically, shows the cash shortfall by month

- Add any planned capital raise – equity or debt – and review what additional amounts you’ll need and when.

- Understand sources and uses of capital – an important element to manage your business for success

- Optimize your financial projections to meet cash flow goals. For example, defer expenses, delay payables, and accelerate receivables to increase cash.

TIP: Better visibility into cash flow projections is key to planning your capital strategy

Create what-if scenarios

Add a what-if scenario to analyze how your business performs under different assumptions or strategies. You may have an internal plan to measure your team and a different one that you’ve committed to investors, for example. Or you may be evaluating different pricing or go-to-market alternatives. Or your sales team has given a range of outcomes that you’d like to model. Whatever the changes, they are simple to implement.

It’s as easy as creating an exact copy and making changes in the input spreadsheet for each scenario. Vary assumptions with driver-based or direct changes.

Compare your scenarios on key measures, including growth rates, capital needs, SaaS and other metrics. View differences in a chart or summary spreadsheet.

TIP: Comparing scenarios and possible outcomes drives more informed decisions